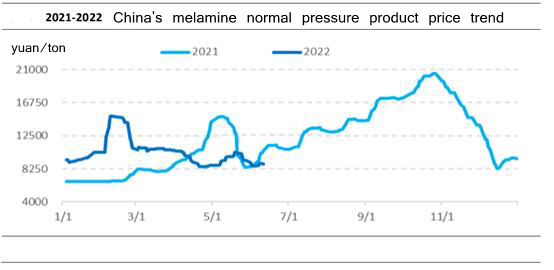

According to data compiled by Huafu Chemicals (the manufacturer of Melamine Molding Powder), as of June 10, the national average ex-factory price was about 8,888 yuan/ton (about 1,319 US dollars/ton), an average increase of 300 yuan/ton compared with the price before the Dragon Boat Festival; a decrease of 5.00% compared with the same period last year.

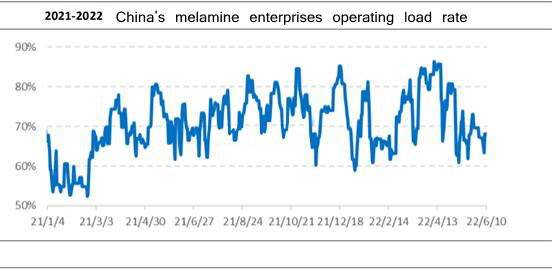

Supply side: high level of enterprise start-up load

Since May, the operating load rate of domestic melamine enterprises has continued to fluctuate around 70%, which is not much different from the same period last year.

Demand side: Downstream demand is sluggish

The domestic downstream market remains sluggish. Affected by various factors, the order follow-up is insufficient, and the market has entered the traditional consumption off-season. It is difficult for the downstream market to have a substantial improvement.

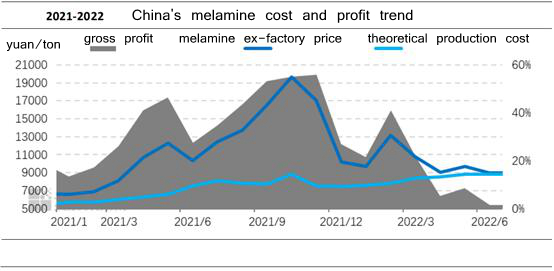

Cost side: Urea prices remain high

The urea market is running strong, the rising trend has slowed down, and the price fluctuates at a high level. The production cost of melamine is still relatively high, and the willingness of manufacturers to support prices has increased significantly.

Market outlook forecast:

1. From the perspective of cost, the price of raw material urea remains high, and it continues to provide a cost-pulling effect on melamine;

2. From the perspective of supply, there is no centralized parking phenomenon for the time being, the operating load rate of the enterprise will remain at about 70%, the daily output will be more than 4,000 tons, and the output of goods will be stable;

3. From the perspective of demand, summer is a low season for traditional downstream consumption, and it is difficult to see a substantial improvement in a short period of time. The demand is light and the digestion of raw materials is slow.

Huafu Chemicals believes that the short-term domestic melamine market lacks momentum to rebound. As high-end shipments have been under pressure again recently, the actual transaction has shown signs of loosening, and it is expected that the room for decline is limited.

Post time: Jun-16-2022